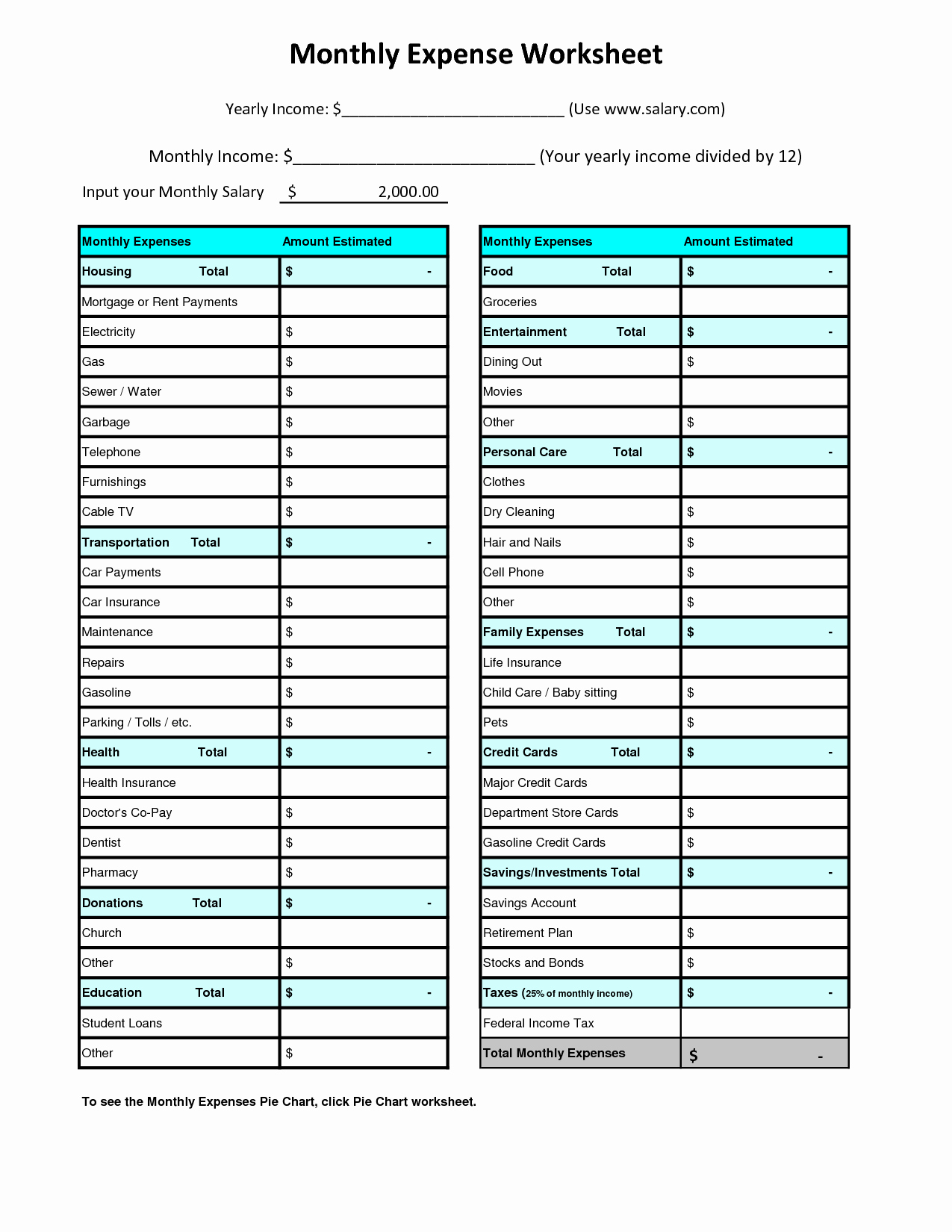

General Expenses include rent, insurance, utility bills, ISP bills, maintenance, etc. This section consists of subcategories of expenses like general expenses, Travel, family expenses, recreation expenses, health expenses, and holiday expenses, etc. This section can be customized as per your needs. Saving Section consists of general saving, money for any emergency, saving for retirement policies, etc. Income-generating sources include Salary, dividends, income from interest, rental income, etc. In this section, you need to input all the different income generating sources of an individual. The header section consists of the heading of the Personal Budget template and the month for which the personal budget is prepared. This template consists of 5 sections: Header Section, Income Section, Savings Section, Expenditure Section, and Graphical Overview Section. Let us discuss the contents of the Personal Budget Template in detail. This template is useful to everyone but especially for working individuals and students. Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

#Track monthly expenses excel download#

You can also download personal finance templates like Debt Reduction Calculator, Monthly Household Budget, and Loan Amortization Template from our website. We have created a Personal Budget Template with predefined formulas and a graphical overview of the financials.Ĭlick here to Download All Personal Finance Excel Templates for ₹299.

Personal Budget Template (Excel, Google Sheet, OpenOffice) For example, retirement plans, saving for emergencies, investment, or education. The saving part includes money allocation for our financial goals. For example, groceries, fuel, transportation, entertainment, gifts, shopping, etc. Whereas variable expenses are of the different amounts each month. For example, loan EMIs, mortgage payments, 401K payments, insurance payments, etc. Fixed expenses are of the same amount and recurring in nature. The expenditure part includes both fixed and variable expenses.

The income part includes income from every source like salary, pension, reimbursements, dividends from invest meant in the stock market, income from rental property, etc. Components of a Personal BudgetĪ personal budget consists of 3 main components: Income, Expenditure, and Savings. Thus, budgeting is very helpful and should be an important part of our financial management.

0 kommentar(er)

0 kommentar(er)